Super-deduction allowance announced by the government in their 2021 Spring Budget comes to an end for claims on 31 March 2023.

Kayleigh Wilson, Tax Manager at Stephenson Smart, highlights that if you are a company that is looking to purchase new plant and machinery you may want to take advantage of this allowance before it ends.

What is super-deduction allowance?

Super-deduction works alongside the Annual Investment Allowance and gives 130 per cent deduction against the purchase of new plant and machinery. However, it is only applicable to companies and for the purchase of new equipment.

Unlike the Annual Investment Allowance, there is no upper expenditure limit on super-deduction.

Example:

Purchasing a new tractor for 100,000 pounds.

Annual Investment Allowance – 100 per cent deduction = 100,000 pounds.

Corporation Tax at 19 per cent = tax saving of 19,000 pounds

Super-deduction – 130 per cent deduction = 130,000 pounds

Corporation Tax at 19 per cent = tax saving 24,700 pounds

As illustrated above, under the temporary super-deduction your company could gain an additional tax saving of 5,700 pounds.

What is Annual Investment Allowance?

Annual Investment Allowance gives 100 per cent deduction against business profits for the purchase of qualifying plant and machinery.

The current expenditure limit is 1 million pounds. It was announced in the 2022 Autumn Statement that this would remain at this level indefinitely.

Any expenditure in excess of this limit goes into a Main Pool or Special Rate pool for tax purposes and attract Capital Allowances at either 18 per cent or 6 per cent per annum.

There is also a 50 per cent first-year allowance for assets that would ordinarily qualify for the Special Rate Pool. However, if you have any remaining Annual Investment Allowance to use you should utilise that first to get 100 per cent deduction rather than 50 per cent deduction.

Do vehicles qualify for super-deduction?

Commercial vehicles such as lorries and vans do but cars do not. However, electric cars still qualify for the 100 per cent First Year Allowances.

Planning and timing are key to making the most of super-deduction and the Annual Investment Allowance. At Stephenson Smart we can help you get this right, please get in touch if we can support you with this.

Did you find this insight useful?

Why not share online

More Insights from Stephenson Smart

26th June 2020

Business to business support in challenging times

Richard Crossley set up Crossnet Creative, specialising in web development and graphic design, just over a year ago. With companies diversifying to keep afloat during the coronavrius pandemic, Richard has found himself inundated with rebranding and signage requests to allow ...

6th December 2023

Advisory fuel rates for company cars

Advisory fuel rates company car - an overview by Partner, Chris Goad: New company car advisory fuel rates have been published and took effect from 1 December 2023. The guidance states: ‘you can use the previous rates for up to one month ...

13th May 2021

New era at King’s Lynn office

It's a new era for Stephenson Smart's King's Lynn office as long-serving partner, Mike Andrews takes on the role of Managing Partner, after the retirement of company stalwart Clive Dodds. Also, Dan Jastrzebski has been made partner, while Jenna Noble, ...

14th May 2020

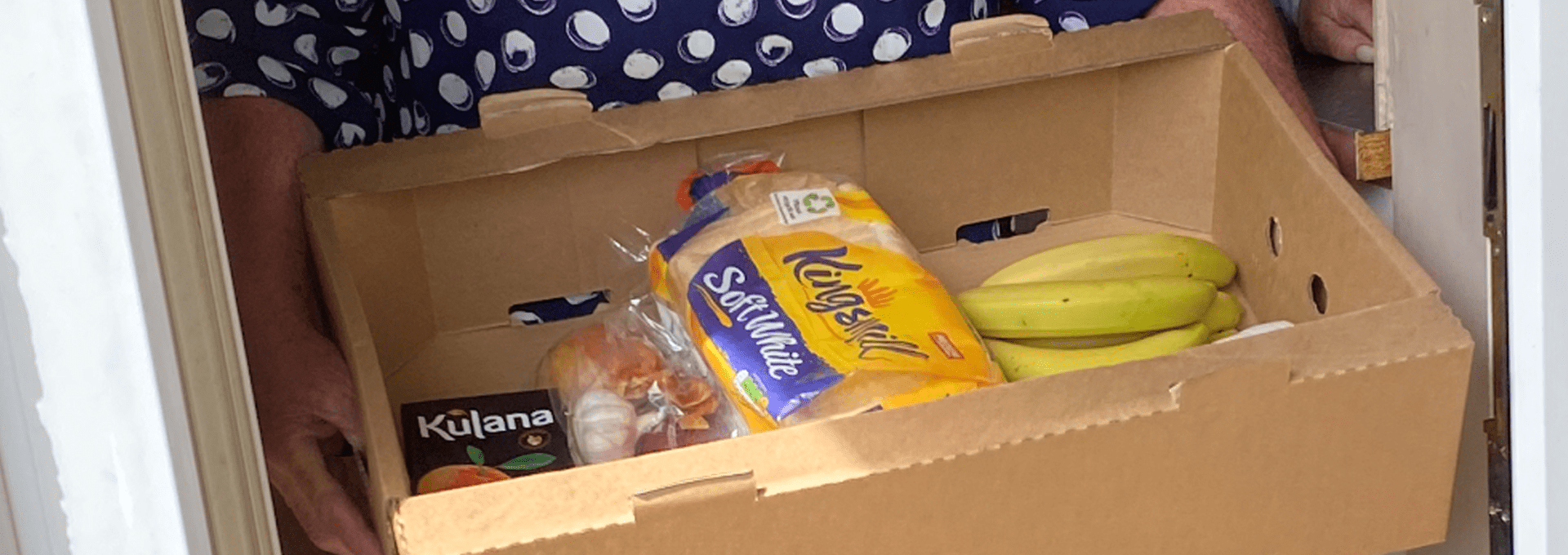

Accent Fresh adapts to support lockdown families

Accent Fresh in Downham Market are renowned for providing fresh produce and food ingredients to schools, canteens and the hospitality industry across East Anglia. In the wake of coronavirus they lost 90 per cent of their business revenue overnight and ...

17th March 2021

Post-Brexit VAT Rules

With the news that the UK is now officially out of the EU, there are significant adjustments in play for businesses that use export operations and consideration needed for post-Brexit VAT rules. The rules for supplying services between Great Britain ...